Services

Microfinance

- Microfinance

- The Division will focus on:

- JANSEVA’s initiatives

- Innovative Model’s of Microfinance

- Daily/Weekly/Monthly saving deposit-

- Grant/revolving fund-

- Interest Free Loan

- Repayment schedule-

- Daily/Weekly/Monthly saving deposit-

- To create awareness cum gender sensitization campaign

- To form Self Help Groups

- To arrange training programs for staff and volunteer group leaders

- To raise capital for MF and administration

- To arrange skill development programs for the beneficiaries

- Create a linkage with government agencies and financial institutions

The division will impact in the areas of livelihoods, community and civil society participation of the SHG members. The ultimate impact will be gender equality and overall empowerment, their capacity building and uplifting them from below to above poverty line. Janseva will anticipate results in the future to Realization of Self Potential, Increase in Savings/ Interest free credit, Gainful occupation, Increase in family income, Increase in Standard of living and Promotion of Civil Society.

Self help group (SHG) model of micro finance as poverty alleviation tool was adopted by Janseva from the very beginning; as SHG model has proved to be most effective tool for alleviating poverty. Reports suggest that making women, hold secondary status; economically active makes them gainfully occupied, double the family income and thereby improve education, health for children especially girl child. This will solve issues faced Muslims in dealing with loan and credit in availing micro finance.

- Provide Interest free Micro Finance to people and also savings.

- Helping them raise income, build up assets and/or cushion themselves against external shocks.

- Reach large numbers of poor people in working area of society.

- Encourage building financial solutions by local institutions.

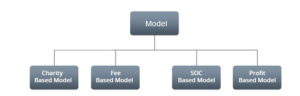

JANSEVA has decided to adopt fee based model in its initial stage, its target of society that model will move to fee based model to profit based model with in two year. The new model of microfinance will be set at a successful role model of interest free microfinance.

After receiving skill training they will be able to run small business and incentive of the member is profit in business with profit sharing basis. 70 % of the profit will be distributed among the members. Fee Based Model

- Amanah Compulsory Saving Deposit Account (ACSD)

- Amanah Current Deposit Account (ACD)

- SHG Savings Deposit Account (SHGSD)

- Mutual Help Fund Deposit Account (MHFD)

- Service/Support Recurring Deposit account (SSRD)

Other Services

Interest Free Business Loan-

Profit Distribution

Repayment schedule of business loan

The minimum investments in various kinds of schemes will be decided by the society from time to time.

Growth Investment Fund Deposits

ABOUT US

Janseva has been promoted by group of people drawn from different states of India. However it owes its existence to the decisions of Board of Trustees of All India Council of Muslim Economic Upliftment Mumbai (AICMEU) and Community Coordination Initiative (CCI).

CONTACT INFO

Janseva Cooperative Credit Society Ltd, 7/25 A 2nd Floor Grant building Arthur Bunder Road,

Near Radio Club , Colaba Mumbai 400005

Tel. - 022 22818178

Email - janseva@janseva.in