Services

Social Banking

- Social Banking

- Shares and deposit mobilization

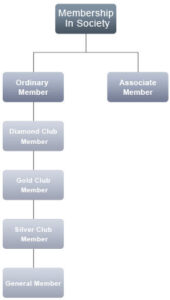

- Eligibility for Membership

- Ordinary Member

- Diamond Club Members

- Gold Club Member

- Silver Club Member

- General Member

- Demand Deposits

- Term Deposits

Society has its objective to provide best financial services to the society members.

- Shares and deposit mobilization

- Honouring withdrawals

- Loans and financing

Any citizen of India, subscribing to the objectives, policy and programs of the society and competent to contract under Indian Contract Act 1872(9) having residence or occupation in operational areas of the society i.e. in the states of Andhra Pradesh, Bihar, Chhattisgarh, Delhi, Karnataka, Madhya Pradesh, Maharashtra, Orissa, Rajasthan, Tamil Nadu, Uttar Pradesh and West Bengal will be eligible to become member of the society.

- Amanah Compulsory Saving Deposit Account (ACSD)

- Amanah Current Deposit Account (ACD)

- SHG Savings Deposit Account (SHGSD)

- Mutual Help Fund Deposit Account (MHFD)

- Service/Support Recurring Deposit account (SSRD)

- Recurring Investment Deposit Account (RID)

- SHG Corpus Fund Deposit Account (SHGCFD)

- Asset Based Investment Deposit Account (ABID)

- Portfolio Investment Deposit Account (PID)

- Participatory Business Investment Deposit Account (PBID)

- General Investment deposit Account (GID)

- SPV Investment Deposit Account (SPVID)

- Security Deposit Account (SD)

Other Services

Amanah Compulsory Saving Deposit Account (ACSD)

Amanah Current Deposit Account (ACD)

SHG Savings Deposit Account (SHGSD)

Mutual Help Fund Deposit Account (MHFD)

Service/Support Recurring Deposit account (SSRD)

Term Deposits

Recurring Investment Deposit Account (RID)

SHG Corpus Fund Deposit Account (SHGCFD)

Asset Based Investment Deposit Account (ABID)

Portfolio Investment Deposit Account (PID)

SPV Investment Deposit Account (SPVID)

The minimum investments in various kinds of schemes will be decided by the society from time to time.

Participatory Business Investment Deposit Account (PBID)

General Investment deposit Account (GID)

Security Deposit Account (SD)

Honouring withdrawals

Loan and Financing

Interest Free Loan:

Categories of loan in order of priority

- Debt repayment loans

- Business participatory loans

- Micro credit to SHG’s

- General Loans

- Educational loans

- Medical loans

- Housing loans

- Any other as decided by the board/area managing board

Debt Financing:

Funds mobilized from special accounts and other idle funds. Debt financing facility will be provided to the members on decided terms and conditions or as decided by the Board from time to time.

- Murabaha,

- Mudarebaha,

- Musharaka,

- Diminishing Musharaka,

- Ijarah , Ishtishna Etc.

Eligibility for Loan

Members desirous to avail loan facility shall have to apply in a prescribed loan application form subject to the condition that they hold shares of the society worth minimum 2.5% value of loan in case of secured loan and 5% value of the unsecured loan applied.

ABOUT US

Janseva has been promoted by group of people drawn from different states of India. However it owes its existence to the decisions of Board of Trustees of All India Council of Muslim Economic Upliftment Mumbai (AICMEU) and Community Coordination Initiative (CCI).

CONTACT INFO

Janseva Cooperative Credit Society Ltd, 7/25 A 2nd Floor Grant building Arthur Bunder Road,

Near Radio Club , Colaba Mumbai 400005

Tel. - 022 22818178

Email - janseva@janseva.in