Janseva Co-operative Credit Society Ltd.

Registration No. :- MSCS / CR / 335 / 2010

Registration No. :- MSCS / CR / 335 / 2010

Janseva Cooperative Credit Society Ltd has established Micro Finance Division to empower marginalized sections and challenged women and men by providing access to Microfinance services. Janseva has also decided to conduct its financial transactions on interest free basis to overcome the reluctance of the targeted group because of the involvement of interest.

The Division will focus on:

The division will impact in the areas of livelihoods, community and civil society participation of the SHG members. The ultimate impact will be gender equality and overall empowerment, their capacity building and uplifting them from below to above poverty line. Janseva will anticipate results in the future to Realization of Self Potential, Increase in Savings/ Interest free credit, Gainful occupation, Increase in family income, Increase in Standard of living and Promotion of Civil Society.

Self help group (SHG) model of micro finance as poverty alleviation tool was adopted by Janseva from the very beginning; as SHG model has proved to be most effective tool for alleviating poverty. Reports suggest that making women, hold secondary status; economically active makes them gainfully occupied, double the family income and thereby improve education, health for children especially girl child. This will solve issues faced Muslims in dealing with loan and credit in availing micro finance.

JANSEVA’s initiatives

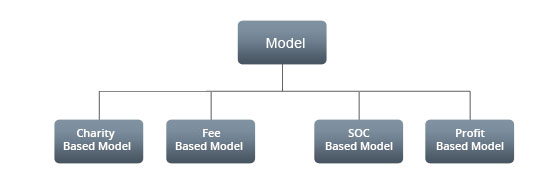

Innovative Model’s of Microfinance

JANSEVA has decided to adopt fee based model in its initial stage, its target of society that model will move to fee based model to profit based model with in two year. The new model of microfinance will be set at a successful role model of interest free microfinance.

After receiving skill training they will be able to run small business and incentive of the member is profit in business with profit sharing basis. 70 % of the profit will be distributed among the members. Fee Based Model

Daily/Weekly/Monthly saving deposit-

Each SHG member will save Rs.5 per day for minimum 25 days per month. However members/grouped will have option to deposit their savings on weekly basis also. In certain cases savings deposits can also be allowed on fortnightly and monthly basis also. Of the total one hundred twenty five rupees deposited by a member or Rs. 1875 by a group, Rs 1500 will be savings and Rs 375 will be deducted by the JANSEVA as monthly membership fees.

Grant/revolving fund-

After successful three months of savings deposits, grant will be provided to all member of SHG on the basis of selection process and grant guideline (Members attendance, loan utilization etc.)

Interest Free Loan-

After successful one year with deposit savings and internal loan repayments, SHG will be eligible for the interest free loan which will be twice the amount saved (saving) after 12 month. Loan will be issued on the basis of Joint liability and no collateral security will be asked. For availing loan SHG will be pay processing fee which is 1% of loan amount so society will cover the disbursement expenses and also SHG will contribute 4% of the loan amount in its own fund which is the growth amount of SHG if any member will fail to deposit loan amount, SHG may use this fund to pay loan of the defaulted member. The balance will be shared by the members of the group after three years or the time of closure of the account.

Repayment schedule-

Repayment Schedule is optional SHG member can chose Daily/weekly /monthly any one of them. If SHG select the weekly repayment schedule then SHG member will pay Rs- XX in a week as loan repayment and also saving amount which will remains same. Profit Based Model After successful completion of two year of savings and internal landing JANSEVA will adopt the profit based model. In this model JANSEVA will issue the loan for small business in partnership with the members of SHG.

Daily/Weekly/Monthly saving deposit-

Each SHG member will save Rs.5 per day for minimum 25 days per month. However members/grouped will have option to deposit their savings on weekly basis also. In certain cases savings deposits can also be allowed on fortnightly and monthly basis also. In every Month, one hundred rupees will be deposited by a member or Rs. 1500 by a group, no monthly membership fee.

Interest Free Business Loan-

After successful two year with deposit savings and internal loan repayments, SHG will be eligible for the interest free business loan which will be twice/more the amount saved (saving) after 24 month. Loan will be issued on the basis of Joint liability and no collateral security will be asked. SHG will contribute 4% of the loan amount in its reserve fund which is the growth amount of SHG Business. If Business will fail, SHG may use this fund to pay loan and run the business. The balance will be shared by the members of the group after three years or the time of closure of the account.

Profit Distribution-

After successful running the business in partnership with JANSEVA, profit will be distributed in ratio of 3:7. 70% of the profit will distributed to members of SHG, 30 % of Profit will be kept by JANSEVA to cover the Expenses and create the reserve for SHG’s.

Repayment schedule of business loan-

Repayment Schedule is optional SHG member can chose Daily/weekly /monthly any one of them. If SHG select the monthly repayment schedule then SHG member will pay Rs- 1000 in a Month as business loan repayment and also saving amount which will remains same.

Growth Investment Fund Deposits

To help members who dream and desire their savings grow 100 % in short time. We target this growth in no more than six years. Janseva introduces this new deposit scheme keeping in view future needs in the field of children’s education, marriage, haj / umrah pilgrimage, housing, capital / asset creation and any other future plan warranting huge monetary requirement.